File Your Claims Now - No Waiting or Holding!

Any Carrier, Any Policy, Any Claim, Any Time

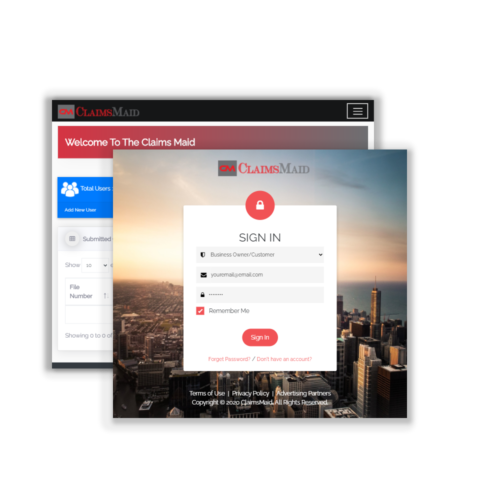

No more calling and being placed on hold. Unleash the power of digital with

ClaimsMaid App and file your claims fast and easy. You now have the power

at your fingertips. App offers you insurance knowledge, policy storage and

24/7 Claim Filing.

About Claims Maid

ClaimsMaid App allow insurance consumers to file/submit claims in real time, for both Commercial and Personal lines of business. Its patent pending app was designed and developed by an adjuster with over 25 years of experience.

Benefits of ClaimsMaid

Flexible

Can be use to report personal and commercial claims

Eliminate

Unnecessary call wait times to explain what happen to a call center rep OR logging into multiple apps to report claims

Seamlessly

Update policy information when and if you decide to SWITCH carriers

Control

A one APP solution, putting you the consumer in control of reporting the facts of the accident in real-time.

Savings

Reporting a claim timely saves you time and money

ClaimsMaid: A new way, A better way, A smarter way

Product

Create a product based solely on what’s known to be best for customer.

Service

Utilize digital tools to service business customers in a unique and innovative way.

Experience

Improve the customer experience with the insured starting with FNOL/FROI.

Lines of Business

Commercial

Business Auto

This coverage is available to protect your business from

the liability associated with operating automobiles.

General Liability

This coverage protects your business from claims arising

office equipment, computers, inventory or tools.

based business if you have a loss.

property on an airbnb, or other platform requires you to inform your homeowners insurance carrier. You willl need to get a separate policy for renting your home on a short term basis. Your homeowners insurance will not provide coverage to you if short term renters damage your property, cause damage to a third party, or is injured while renting your home, condo, etc.

Workers Compensation insurance for their employees. This insurance provides coverage for accidents or disease arising from employment as prescribed by these state laws. Benefits can include lost wages, medical expenses, and permanent disfigurement/disability payments.

negligent acts, errors or omissions in the rendering or failing to render professional services as defined in the policy

personal auto for the times you are signed in to a ridesharing app, but not covered by Uber, Lyft, or any Delivery service insurance. Certain personal auto insurance policies will add this endorsement to an existing auto policy for additoinal costs.

a data breach relating to sensitive customer information, such as credit card numbers, account numbers, driver’s license numbers, Social Security numbers and health records.

serving as a director or an officer of an organization or business, Directors and Officers liability insurance can provide protection. This protection can cover legal fees and other incurred cost by the organization or business.

Personal

on the vehicle. This insurance is needed not only to protect you and your auto, but it is needed to protect others that might sustained damages as a result of your damaging their auto, or property.

your residence and contents in the event of an incident. Protecting your property as a homeowner is very important. Homeowners insurance can also provide liability coverage in the event someone is injured in or around your property.

for motorcycle operation. This will cover injuries and property damage caused to others. Collision insurance covers damage to the motorcycle if one is involved in a collision with another vehicle.

condo, loft, duplex, or townhouse, you should get an insurance policy to cover you and your property. This is often an overlook protection which you can get for a nominal amount, but will provide much needed coverage. Most property owners or management companies will require renters insurance as they would like to be protected from losses as well.

replacing it (with refurbished phone) if it’s accidentally damaged, lost or stolen. Some policies will also reimburse you for any calls or data charges incurred if your phone is lost or stolen.

unforeseen losses incurred while travelling, either domestically or internationally. One can obtain basic travel policies that cover only emergency medical expenses while overseas, or a more comprehensive policy with additional coverage, like trip cancellation and more.

How It Works?

For ten (10) or more locations pricing please email info@claimsmaid.com.

*Locations are only needed for commercial, not Personal.

Data and Payment Security

When it comes to data and payment security, we do not compromise at all.

It is very important to protect your data and payments, which is why our website is fully secured with SSL (Secure Sockets Layer). Payments are securely processed via PayPal, one of the most trusted payment platforms used by millions of businesses worldwide.

When it comes to login security, we ensure that users create strong passwords, and these passwords are encrypted from the moment they are sent to when they are saved, so even we cannot access your chosen password.

We do not share or sell your data with any third-party without your consent. Additionally, sensitive payment information such as your Credit Card Number, CVV, or PIN is never stored by us.

Our Pricing

Small Businesses and Non-Profits Buy Commercial Get Personal FREE

Commercial

-

$1 processing fee to unlock all the features of ClaimsMaid

*All plans are subject to paying minimum processing fee.

Personal

-

$1 processing fee to unlock all the features of ClaimsMaid

*All plans are subject to paying minimum processing fee.

Limited time offer prices subject to change without notice.

Business Concerns

The era of COVID19 has made is even more crucial that small to medium size businesses understand the importance of insurance. At ClaimsMaid, we will work hard and diligently to help nurture small businesses, thinking first about the customer and catering to their specific needs.

Innovation

Re-Imagine

Community

Give-A-Gift

Now is the perfect time for patrons and organizations to help those groups who are struggling. Why not give ClaimsMaid to your favorite business, or individual.

Frequently Asked Questions

Commercial: Auto, Rideshare/Delivery, Professional Liability, General Liability, Business Property, Workers Compensation and Homeshare

Personal: Auto, Homeowners, and Renters

Yes. For our special pricing and introductory offer, please e-mail us via partners@claimsmaid.com.

Sign Up for Newsletter

Subscribe to our newsletter today to receive updates on the latest news and special offers! We respect your privacy. Your information is safe and will never be shared.